CALL FOR PROJECTS

Join the Perspectives Entrepreneurs program!

Perspectives Entrepreneurs gets you ready to raise venture capital, with workshops and personalized coaching to structure the growth of your impact project.

By joining the cohort, you’ll enjoy a unique experience alongside experts, investors and like-minded women or non-binary entrepreneurs.

Take advantage of a dedicated community of practice, which, in parallel to your journey, will connect you to impact-conscious and gender-aware investors, offering unique networking opportunities.

Up to 10h of coaching tailored to your objectives with our finance experts

You will learn the essential skills and tools for successful fundraising

To empower your pitch and make it more convincing

Pitch your project to potential investors

Attend investor pitches promoting their investment funds

Meet key investors in exclusive sessions

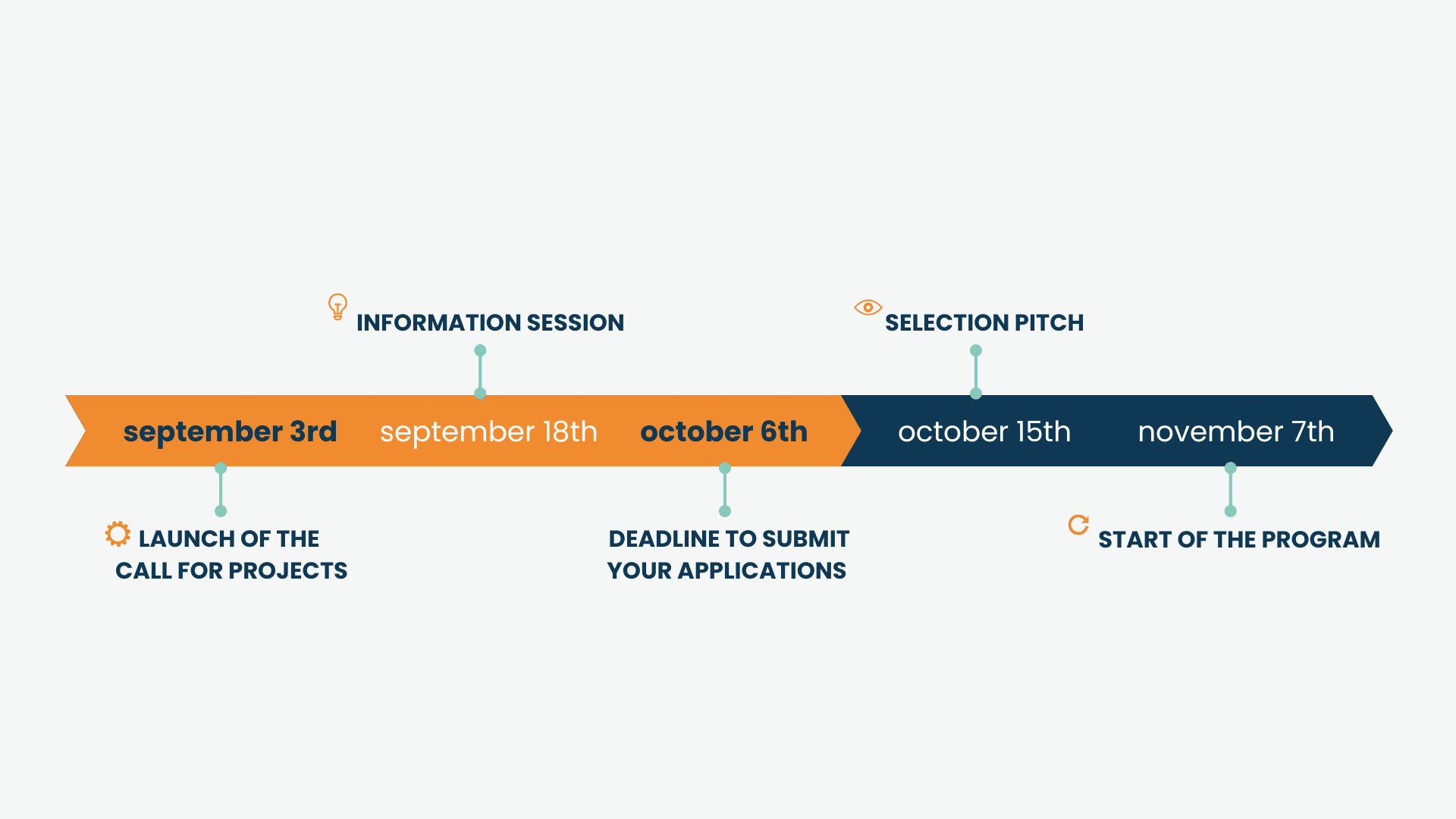

A free virtual information session was held on September 18 (in French).

During the program, up to 10h of personalized coaching will be offered to support you in achieving your business objectives.

Corporate development, mergers and acquisitions

Market Research, Marketing and Business Development

Strategy thinking, financial modeling and financing strategies

You are a female or non-binary entrepreneur, co-founder, owner, founder or manager of a for-profit company (INC).

Your company is in the growth stage, with a validated business model and initial sales (exceptions possible for the healthcare sector).

You are aiming to raise a significant amount of venture capital in the next 24 to 36 months or are actively considering fund-raising.

Your project has a clear social and environmental impact, whatever its sector of activity.

Your company is based in Quebec.

Your company must have strong growth potential, requiring substantial funds (venture capital).

You must be committed and available to participate in the program.

You have a solid business model, with a clear value and impact proposition and a defined market strategy.

Your company must show significant progress and evidence of traction, such as sales or partnerships.

Workshops are held face-to-face (hybrid format available) at the CDPQ every 2-3 weeks, on Thursday mornings from 9am to 12pm, on the following dates:

November 7 November 21 December 5 January 9 January 23 February 6 February 20 March 13 March 27 (Town Hall: pitch to investors)

Finally, the 10 hours of one-to-one coaching, as well as the individual pitch sessions, can be planned flexibly with your coach, according to your schedule, and run until June 2025.

The Perspectives Entrepreneurs Program offers comprehensive support for women and non-binary entrepreneurs seeking to raise venture capital.

8 workshops in a hybrid format to provide you with all the essential skills for successful fundraising and sustainable growth

Up to 10 hours of personalized coaching tailored to your needs with finance experts

A Town Hall to practice pitching to investors and get valuable feedback to empower your pitch

Networking opportunities with like-minded investors

Networking, and exchanges opportunities

Explore the various financing opportunities and packages available for your project

Rethink the gender dimension and integrate it into your pitches

Master the art of pitching and practice in front of investors

Learn more about boards of directors, advisory committees, etc..

Review your financing files and enhance your value proposition

Learn how to negotiate with the invaluable advice of a lawyer

Integrate your mission and its impact into your presentations

The Perspectives Entrepreneurs program is:

A safe place to ask questions and get answers.

A clear understanding of VC expectations.

Help in defining a financing strategy aligned with your growth and impact.

Intensive preparation for fundraising.

Support in identifying aligned financial partners and developing lasting relationships.

An exchange on bias towards women and non-binary people.

It is not:

A fundraising guarantee.

A turnkey solution.

Direct financing.

The selection process will take place in 2 phases:

Pre-selection on the basis of applications: an initial selection will be made on reception of the application. Applications will be analyzed and you will receive confirmation of your pre-selection around October 9.

Selection by a jury: shortlisted entrepreneurs will be invited to present their pitch to a virtual jury on October 15. At the end of this pitch session, 8 to 10 entrepreneurs will be selected to form the next Perspectives Entrepreneurs cohort.

The jury’s final decision will be announced around October 21.

For this call for projects, any type of business sector is eligible, as long as the project has a proven social and environmental impact.

We are particularly interested in the environment, healthcare and food systems sectors.

Sometimes, raising venture capital funds isn’t the best way to go – and that’s exactly what we want to help you clarify in the Perspectives Entrepreneurs program.

Venture capital (or VC) can be a powerful solution for innovative young companies with high growth potential. It provides equity financing to support growth at critical moments, particularly when bank loans are hard to obtain. But is VC really right for your company? Here are some tips to help you ask the right questions:

How does it work?

Venture capitalists (private funds or institutional investors) invest in young, innovative companies with high growth potential, with the aim of generating significant returns when their shares are resold. Their investment horizon is generally 5 to 10 years. As a shareholder, a VC investor enjoys specific rights, such as access to management information and the power to approve certain management decisions. They can request a seat on the Board of Directors, either for their organization or for an independent director. In addition to financing, a VC investor can bring his or her network and specific skills to the table.

But ask yourself: Are you ready to share control of your company with outside investors? Does this fit in with your vision of running your business? What type of investor should you choose?

There are two main types of venture capital investor (non-exhaustive list):

Institutional investors are financial entities with the capacity to make investments on their own behalf, and with substantial resources at their disposal. Institutional investors include insurance companies, savings banks, banks and pension funds. Private equity is a type of asset in which they invest. They provide equity financing for companies. This can involve companies of any size and in any sector. When they invest in young, innovative companies with high growth potential, they are referred to as venture capitalists.

They are more generalist and less directly involved in company management. As they have substantial funds at their disposal, they are not always constrained by investment duration (evergreen funds) and are able to reinvest in a new round of financing, but they will not always be at your side for operational decisions.

Venture capitalists specialize exclusively in venture capital investments in young companies with high growth potential. These funds generally have a limited lifespan (7 to 12 years).

A single venture capital firm may position itself in several specific segments in terms of sector, entrepreneur profile, business model or theme, defining its investment thesis. This specialization enables them to more actively support the companies in which they invest, offering both operational and strategic support.

So, what type of investor is best suited to your project? Are you looking for a committed strategic partner, or for discreet but lasting financial support? Or both?

Raising venture capital funds can be an incredible opportunity to accelerate your company’s growth. However, it often means giving up part of your business and accepting the idea of eventually exiting (via a sale or IPO, for example). This model is not for every company, nor every entrepreneur.

Ask yourself these questions: Do I really need this cash injection to grow? Am I ready to cede some control of my company?

Does venture capital align with my long-term goals? If you’re not sure, or if you’re asking yourself these questions intensively, it’s a great idea to come and discuss them at the Perspectives Entrepreneurs program. We’ll help you assess whether VC is the best option for your company, or whether other alternatives, such as non-dilutive financing, might be a better fit.

A free virtual information session will be held on September 18 from 12pm to 1pm.

The Perspectives Entrepreneurs program is managed by Yolène Rosello.

You can write to her at yolene@esplanade.quebec.

This program is offered as part of the national initiative WIN-VC (The Women and Nonbinary Impact Network for Venture Capital). To learn more, visit the website.